All Categories

Featured

Table of Contents

They commonly give an amount of insurance coverage for much less than irreversible kinds of life insurance policy. Like any policy, term life insurance policy has advantages and disadvantages relying on what will work best for you. The benefits of term life consist of cost and the ability to customize your term length and coverage amount based on your requirements.

Depending on the type of plan, term life can use set premiums for the whole term or life insurance coverage on degree terms. The death benefits can be dealt with.

Outstanding Voluntary Term Life Insurance

You need to consult your tax obligation experts for your particular factual scenario. Rates mirror plans in the Preferred And also Rate Class problems by American General 5 Stars My agent was very educated and practical while doing so. No pressure to get and the process was quick. July 13, 2023 5 Stars I was pleased that all my needs were met quickly and skillfully by all the representatives I talked to.

All paperwork was digitally finished with accessibility to downloading and install for individual file upkeep. June 19, 2023 The endorsements/testimonials presented need to not be construed as a referral to purchase, or an indicator of the value of any item or solution. The reviews are actual Corebridge Direct customers who are not associated with Corebridge Direct and were not supplied compensation.

1 Life Insurance Policy Stats, Information And Market Trends 2024. 2 Price of insurance coverage rates are determined making use of methodologies that vary by business. These prices can differ and will usually increase with age. Prices for energetic employees may be different than those available to ended or retired employees. It is essential to check out all elements when assessing the general competition of rates and the worth of life insurance policy coverage.

Honest Decreasing Term Life Insurance

Like most group insurance plans, insurance plans offered by MetLife include specific exclusions, exemptions, waiting durations, decreases, restrictions and terms for keeping them in force (term vs universal life insurance). Please call your advantages administrator or MetLife for costs and full information.

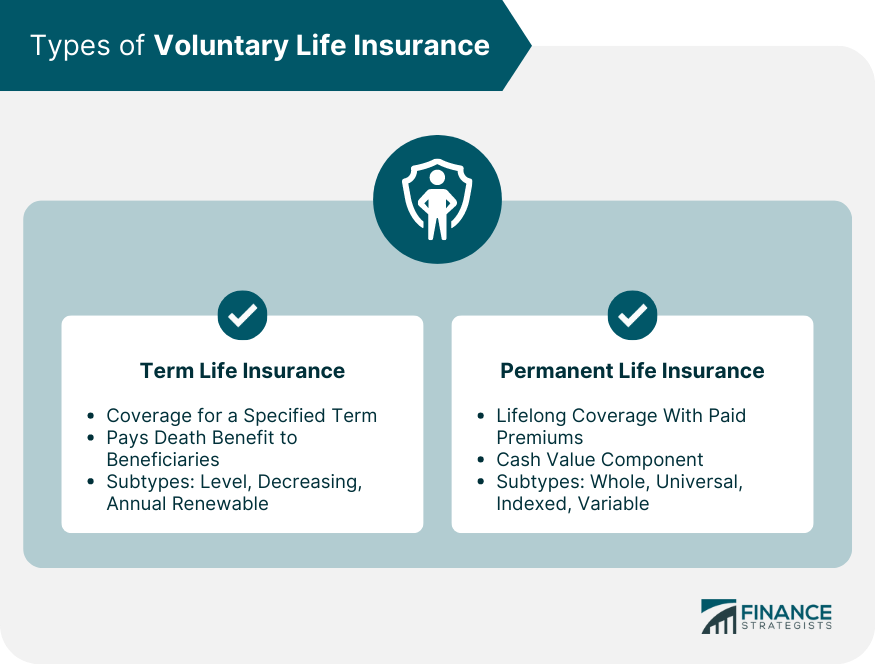

For the a lot of component, there are 2 kinds of life insurance policy plans - either term or irreversible strategies or some mix of the two. Life insurance providers provide various forms of term plans and conventional life plans as well as "rate of interest sensitive" products which have come to be more widespread because the 1980's.

Term insurance provides protection for a specified amount of time. This duration might be as short as one year or supply coverage for a specific number of years such as 5, 10, two decades or to a specified age such as 80 or in many cases as much as the earliest age in the life insurance policy death tables.

Outstanding Level Term Life Insurance Definition

Currently term insurance coverage prices are very competitive and amongst the most affordable traditionally skilled. It should be kept in mind that it is a commonly held idea that term insurance policy is the least costly pure life insurance policy coverage offered. One requires to assess the policy terms meticulously to choose which term life options are appropriate to meet your particular situations.

With each new term the costs is raised. The right to renew the policy without proof of insurability is an important benefit to you. Otherwise, the risk you take is that your health might deteriorate and you might be incapable to get a policy at the exact same rates or also in all, leaving you and your recipients without protection.

You have to exercise this alternative during the conversion duration. The length of the conversion period will differ relying on the kind of term plan bought. If you transform within the proposed duration, you are not called for to offer any kind of information concerning your health. The costs price you pay on conversion is usually based on your "current obtained age", which is your age on the conversion day.

Under a degree term policy the face quantity of the policy stays the exact same for the whole period. With reducing term the face amount reduces over the period. The costs stays the very same annually. Often such policies are offered as home loan security with the amount of insurance policy reducing as the equilibrium of the mortgage decreases.

Generally, insurers have not had the right to transform premiums after the plan is offered (guaranteed issue term life insurance). Given that such policies may proceed for many years, insurers have to use conservative mortality, rate of interest and cost price estimates in the costs estimation. Flexible costs insurance, nonetheless, allows insurance companies to supply insurance policy at reduced "existing" costs based upon less conservative assumptions with the right to change these premiums in the future

Annual Renewable Term Life Insurance

While term insurance policy is designed to give protection for a specified time duration, long-term insurance policy is created to give insurance coverage for your entire lifetime. To maintain the premium price degree, the premium at the more youthful ages exceeds the actual price of protection. This additional costs builds a get (cash value) which helps pay for the policy in later years as the cost of defense surges over the costs.

The insurance coverage firm spends the excess costs dollars This type of policy, which is often called money value life insurance policy, generates a financial savings element. Money worths are important to an irreversible life insurance coverage plan.

Decreasing Term Life Insurance

Occasionally, there is no relationship in between the dimension of the cash money value and the costs paid. It is the money worth of the policy that can be accessed while the insurance holder lives. The Commissioners 1980 Requirement Ordinary Mortality Table (CSO) is the existing table used in determining minimal nonforfeiture worths and plan books for normal life insurance policy policies.

There are two basic classifications of irreversible insurance, conventional and interest-sensitive, each with a number of variants. Typical whole life policies are based upon long-term estimates of cost, passion and death (what is voluntary term life insurance).

If these price quotes alter in later years, the business will certainly readjust the costs as necessary but never over the optimum assured premium mentioned in the policy. An economatic whole life policy offers a fundamental quantity of taking part whole life insurance policy with an extra extra coverage offered through the usage of returns.

Due to the fact that the premiums are paid over a shorter period of time, the costs payments will be greater than under the whole life strategy. Single premium whole life is minimal payment life where one large premium payment is made. The policy is fully paid up and no further costs are required.

Table of Contents

Latest Posts

Best End Of Life Insurance

Senior Life Services Final Expense

Legacy Final Expense

More

Latest Posts

Best End Of Life Insurance

Senior Life Services Final Expense

Legacy Final Expense