All Categories

Featured

Table of Contents

Life insurance policy assists make certain that the economic debt you owe toward your home can be paid if something happens to you. It makes sense to have a plan in place guaranteeing that your family will be able to maintain their home no matter what lies ahead.

In some situations, a combination of insurance coverage types might supply more advantages than a solitary product service, far better securing your home in the occasion that you pass away suddenly. The balance owed on your mortgage would certainly constantly be covered by the mix of one or numerous life insurance coverage policies. mortgage insurance online. Making use of life insurance policy for home loan defense can alleviate the danger of someone being entrusted an uncontrollable economic concern

Tailoring your protection can give temporary defense when your home mortgage quantity is highest and lasting protection to cover the whole period of the home loan. The mix approach can function within your budget, provides flexibility and can be designed to cover all home mortgage settlements. There are different methods to utilize life insurance to help cover your mortgage, whether via a combination of policies or a solitary policy tailored to your needs.

This policy lasts for the complete regard to your mortgage (three decades). In the occasion of your death, your family members can make use of the fatality advantage to either pay off the home mortgage or make ongoing home mortgage repayments. You purchase a whole life insurance policy policy to provide lasting protection that fits your economic situation.

When it comes to securing your liked ones and ensuring the financial security of your home, understanding home loan life insurance coverage is important - what is mortgage insurance and do i need it. Home loan life insurance policy is a specialized kind of insurance coverage created to pay off home loan financial obligations and connected expenses in case of the customer's fatality. Allow's explore the types of home loan life insurance readily available and the advantages they offer

This kind of insurance is frequently utilized in combination with a conventional home mortgage. The size of the policy lowers with time according to the outstanding balance of the home loan. As home mortgage payments are made, the survivor benefit lowers to refer the brand-new amortized mortgage balance impressive. Lowering term insurance policy makes certain that the payout lines up with the staying mortgage debt.

Life Assurance Mortgage

Unlike decreasing term insurance coverage, the dimension of the plan does not decrease in time. The plan supplies a fixed death advantage that continues to be the same throughout the term, regardless of the impressive home mortgage balance. This sort of insurance policy is appropriate for debtors who have interest-only home mortgages and wish to ensure the complete home loan quantity is covered in case of their fatality.

, a number of variables come into play. State and government laws play a substantial function in identifying what occurs to the home and the mortgage when the owner dies.

These regulations determine the procedure and options available to the successors and beneficiaries. It is essential to understand the certain legislations in your jurisdiction to browse the circumstance effectively. If you have called a successor for your home in your will, that individual normally does not have to take control of your mortgage, provided they are not co-borrowers or co-signers on the financing.

Mortgage Protection Life Insurance Quote

The choice inevitably relaxes with the heir.It's essential to take into consideration the economic implications for your heirs and beneficiaries. If the presumed heir fails to make mortgage settlements, the lender maintains the right to foreclose. It may be required to guarantee that the heir can afford not just the mortgage repayments however also the recurring expenditures such as real estate tax, home owners insurance, and maintenance.

In many scenarios, a joint debtor is also a joint owner and will end up being the single proprietor of the building (mortgage insurance life insurance). This indicates they will certainly presume both the possession and the home mortgage commitments. It is essential to keep in mind that unless someone is a co-signer or a co-borrower on the loan, no person is legitimately obligated to proceed settling the home loan after the borrower's fatality

If no one presumes the home loan, the home mortgage servicer may launch foreclosure procedures. Recognizing the state and federal regulations, the influence on beneficiaries and recipients, and the responsibilities of co-borrowers is critical when it comes to navigating the complicated world of home mortgages after the death of the customer. Looking for lawful support and thinking about estate preparation options can help make certain a smoother transition and safeguard the passions of all celebrations involved.

What Is Mortgage Insurance Based On

In this area, we will explore the subjects of inheritance and mortgage transfer, reverse mortgages after fatality, and the role of the enduring spouse. When it pertains to inheriting a home with an exceptional home loan, numerous factors enter into play. If your will names an heir to your home who is not a co-borrower or co-signer on the car loan, they normally will not need to take over the home loan.

In instances where there is no will certainly or the beneficiary is not called in the will, the obligation falls to the administrator of the estate. The administrator ought to proceed making mortgage settlements using funds from the estate while the home's fate is being figured out. If the estate does not have adequate funds or properties, it may need to be sold off to repay the home loan, which can create issues for the heirs.

When one debtor on a joint home mortgage passes away, the surviving partner normally comes to be fully in charge of the home mortgage. A joint borrower is likewise a joint owner, which means the enduring partner becomes the single owner of the residential or commercial property. If the home mortgage was looked for with a co-borrower or co-signer, the other celebration is lawfully obliged to continue making loan repayments.

It is crucial for the enduring spouse to connect with the loan provider, comprehend their legal rights and duties, and check out offered choices to make sure the smooth continuation of the mortgage or make required plans if needed. Recognizing what happens to a home loan after the fatality of the property owner is important for both the heirs and the enduring spouse.

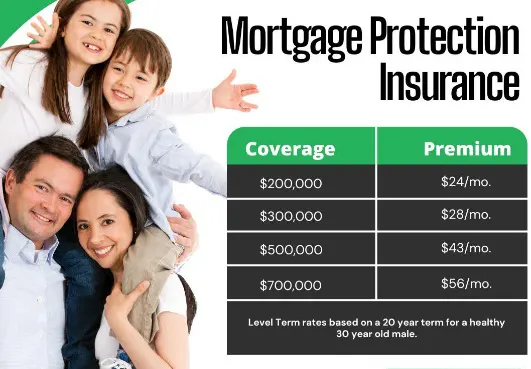

, home loan protection insurance (MPI) can supply beneficial protection. Allow's check out the coverage and advantages of home mortgage defense insurance policy, as well as vital considerations for enrollment.

In case of your death, the fatality benefit is paid straight to the home mortgage loan provider, making sure that the exceptional car loan balance is covered. This permits your household to remain in the home without the included tension of prospective monetary hardship. Among the advantages of home loan defense insurance policy is that it can be an alternative for people with serious health and wellness problems who might not qualify for typical term life insurance policy.

Insurance On House Loan

Enrolling in home loan defense insurance coverage needs careful factor to consider. It is necessary to evaluate the terms of the plan, consisting of the protection amount, costs repayments, and any type of exclusions or limitations. To obtain home mortgage protection insurance, typically, you require to sign up within a few years of closing on your home. This ensures that you have protection in area if the unforeseen takes place.

By recognizing the coverage and benefits of mortgage protection insurance coverage, along with meticulously reviewing your choices, you can make informed choices to safeguard your family's economic wellness even in your absence. When it concerns handling mortgages in Canada after the death of a house owner, there are certain policies and regulations that enter into play.

In Canada, if the dead is the single proprietor of the home, it ends up being an asset that the Estate Trustee called in the person's Will need to manage (loan protection insurance quotes). The Estate Trustee will need to prepare the home to buy and utilize the earnings to repay the remaining mortgage. This is needed for a discharge of the house owner's loan agreement to be signed up

Table of Contents

Latest Posts

Best End Of Life Insurance

Senior Life Services Final Expense

Legacy Final Expense

More

Latest Posts

Best End Of Life Insurance

Senior Life Services Final Expense

Legacy Final Expense